Share this post:

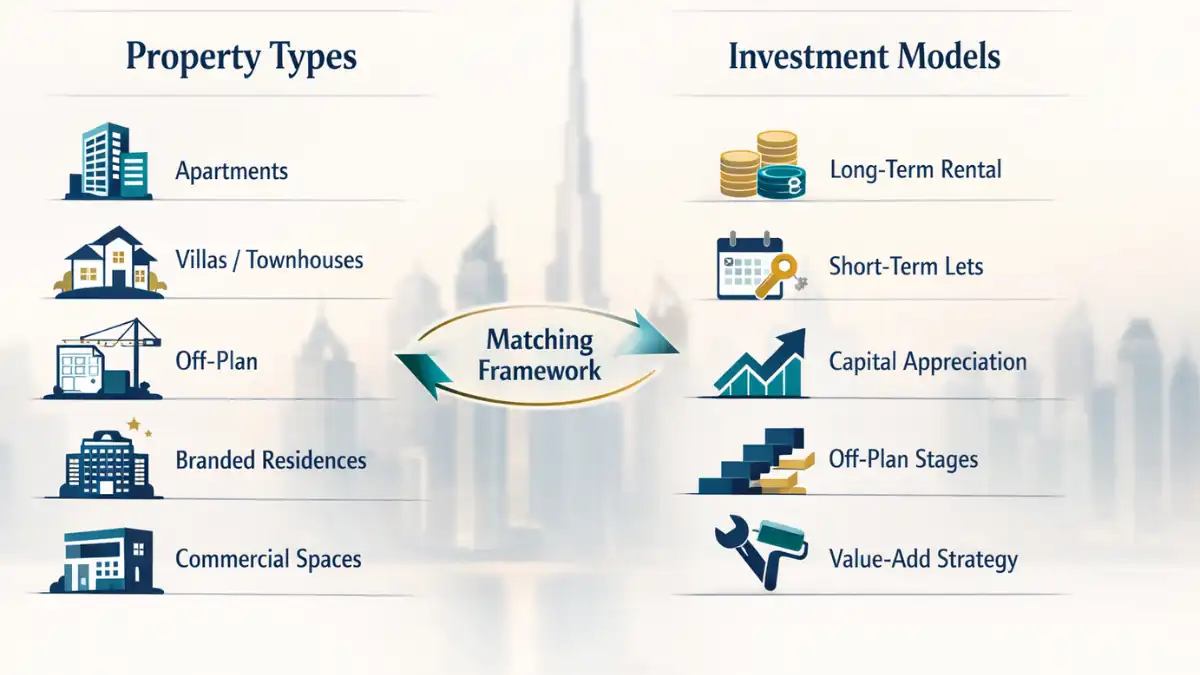

Quick summary: Property Types and Investment Models

Property Types and Investment Models are the two levers that decide whether a Dubai investment feels calm and predictable — or stressful and hard to control. In simple terms: the property type drives demand, running costs and tenant behaviour, while the investment model drives your timeline, cash flow, and exit options.

- If you want steadier income: prioritise proven rental areas, predictable service charges, and a model built around long-term letting.

- If you want capital growth: focus on supply/demand, infrastructure, and a realistic holding period (rather than “quick wins”).

- If you want flexibility: pick property types that resell well, and avoid structures that lock your cash up longer than you planned.

- If you’re buying off-plan: the payment plan is part of your investment model — not just “how you pay”.

The rest of this guide walks you through the main property categories in Dubai, the most common investment models investors use, and a practical way to match the right strategy to your budget, timeline and risk tolerance.

Not sure which strategy actually fits your budget and timeline?

Share what you’re trying to achieve (income, growth, lifestyle use, or a mix) and we’ll help you shortlist the most sensible property types and deal structures for your plan.

Property Types and Investment Models: what investors should understand first

When you’re new to Dubai, it’s tempting to start with the “best area” or the “best project”. However, the smarter starting point is your strategy — because the right property in the wrong strategy can still become a headache.

In our experience, most first-time buyers get better outcomes when they separate the decision into two parts: property type (what you’re buying) and investment model (how you plan to make money and when you plan to exit). That is exactly what this Property Types and Investment Models guide is designed to help you do.

What “property type” really changes

- Demand profile: who rents or buys this type (families, professionals, holiday-makers, end-users).

- Running costs: service charges, maintenance expectations, fit-out cycles and management overhead.

- Resale liquidity: how easy it is to exit if the market shifts or your plan changes.

- Regulatory/admin steps: for example tenancy registration and (where relevant) short-term letting requirements.

What “investment model” really changes

- Your timeline: quick turnaround vs a calmer multi-year hold.

- Cash flow shape: steady rental income vs lumpy returns on resale.

- Your risk points: construction delivery risk, refinancing risk, occupancy risk, or price-cycle risk.

- Your decision rules: what you will do if rents soften, rates rise, or you need to sell sooner than planned.

Property types in Dubai and what they mean for investors

Dubai offers more variety than many first-time buyers expect. The good news is that you can build a sensible plan in several different ways — as long as the property type matches your model. Below are the main categories we see most often with international investors.

Apartments (studios to 3+ beds)

Apartments are often the easiest entry point because they can be simpler to manage and easier to rent in commuter-friendly locations. That said, performance can vary dramatically based on building quality, service charges, and supply levels in the immediate area.

- Best for: professionals, couples, small families (depending on location and layout).

- Watch-outs: high service charges, under-maintained common areas, and “same building competition” (many similar units listed at once).

- Due diligence focus: building management, sinking fund, service charge trend, and unit layout desirability.

Townhouses and villas

Family homes behave differently. They can deliver strong tenant stability and attractive end-user demand, but maintenance and wear-and-tear expectations are higher. You are also more exposed to community-level supply cycles.

- Best for: longer holds, family tenants, end-user resale appeal.

- Watch-outs: maintenance reserves, landscaping, and renovation cycles on older stock.

- Due diligence focus: community fees, handover quality (if newer), and realistic annual upkeep budgeting.

Off-plan units (buying from a developer before completion)

Off-plan is not a “property type” in the physical sense — it’s a purchase route — but it behaves like a distinct category because delivery timelines and payment schedules change your risk and cash flow. Many beginners underestimate this point.

- Best for: investors comfortable with timelines, staged payments and a clear hold or resale plan.

- Watch-outs: changing market conditions by completion, delays, and overreliance on “expected” appreciation.

- Due diligence focus: developer track record, escrow structure, handover standards, and realistic comparable pricing.

Hotel apartments and branded residences

These can look appealing because of brand pull and potential short-stay demand. However, they often come with more complex fee structures, usage rules, and operator arrangements.

- Best for: buyers who value hands-off operation and understand the fee model.

- Watch-outs: operator fees, restricted owner usage, and assumptions based on peak-season income.

- Due diligence focus: net-to-owner income projections, occupancy assumptions, and contract clarity.

Commercial property (offices, retail, warehouses)

Commercial can be attractive for experienced investors, but it is rarely “beginner simple”. Lease structures, vacancy periods, and tenant quality matter a lot.

Investment models: the main strategies buyers actually use

Once you understand the property categories, the next step is choosing the model. Think of an investment model as your “rules of the game”: how you plan to make returns, what you will measure, and how you will respond if conditions change. Here are the most common approaches we see in Dubai.

1) Long-term rental (steady income)

This is the most straightforward model: buy a property that tenants want, keep it well-maintained, and prioritise consistent occupancy over constant trading. It tends to be calmer, particularly if your financing is stable and your running costs are predictable.

- Works best with: well-located apartments, family homes in liveable communities, and stock with strong tenant demand.

- Primary driver: net yield after service charges, maintenance, and management.

- Good for: investors who prefer consistency and a clear “hold” plan.

2) Short-term letting (seasonal / holiday stays)

Short-term letting can deliver higher gross income in the right location and season, but it is also more operationally demanding. Your success depends on occupancy, guest reviews, furnishing quality, and professional management.

- Works best with: well-positioned apartments in areas with consistent visitor demand.

- Primary driver: occupancy rate + nightly rate + operational efficiency.

- Good for: investors comfortable treating it like a small hospitality business.

3) Capital appreciation hold (growth-first)

In a growth-first model, you accept that rental yield may not be the headline — the aim is to benefit from location momentum, infrastructure, and long-term demand. This can work well, but only if your hold period is realistic and you can carry the property comfortably.

- Works best with: supply-constrained pockets, high liveability areas, and assets with genuine end-user appeal.

- Primary driver: resale demand and pricing power over time.

- Good for: investors who can hold through cycles rather than needing a quick exit.

4) Off-plan completion-to-handover strategy

Some buyers aim to secure a strong unit early, pay in stages, then either: (a) hold and rent after handover, or (b) sell after completion if pricing and demand are favourable. The key is that you are managing a timeline and payment plan — not just choosing a property.

- Works best with: credible developers, realistic handover timelines, and a conservative affordability buffer.

- Primary driver: market conditions at completion + your ability to hold if needed.

- Good for: investors with flexibility who won’t be forced to sell at a bad time.

5) Value-add (renovation / repositioning)

Value-add can work when you buy below replacement value and improve the unit meaningfully. The danger is doing “cosmetic spend” without improving what tenants and buyers actually pay for (layout, storage, light, condition, usability).

- Works best with: older but well-located stock where improvements stand out.

- Primary driver: uplift vs total cost (including downtime and fees).

- Good for: investors with the time and oversight to manage works properly.

How to choose: matching property type to investment model

Here is a simple way to decide without overcomplicating things. Start with your non-negotiables, then pick the property type that naturally supports them.

A practical matching framework (use this before you browse listings)

| Your priority | Usually fits best with | What to check first |

|---|---|---|

| Steady income | Rentable apartments / family homes in proven areas | Service charges, vacancy history, realistic net yield |

| Growth-first | End-user-friendly assets in supply-controlled pockets | Comparable resales, pipeline supply, hold comfort |

| Hands-off ownership | Well-managed buildings; sometimes branded/operator-led stock | Fee structure, net-to-owner numbers, contract clarity |

| Flexibility to exit | Liquid segments with consistent buyer demand | Resale volume, typical time-on-market, buyer profile |

The point is not to “find the perfect deal”. It is to pick a model that still works if the market becomes quieter for a period.

Want us to sense-check your strategy before you commit?

Tell us your budget, time horizon, and whether you prefer income or growth. We’ll map the most suitable property categories and buying route for your plan.

Off-plan and payment plans as an investment model

In Dubai, the payment plan is not just a convenience — it is part of your strategy. The schedule determines when your cash is tied up, when your risk peaks, and how much flexibility you have if you want to pivot.

How staged payments change your real “return profile”

- Cash flow timing: staged payments can reduce early cash pressure, but they also delay rental income (and sometimes delay your ability to refinance).

- Market risk timing: your biggest exposure is often around completion and handover, when many buyers in the same project become sellers at once.

- Exit options: your realistic exits depend on contract terms, market depth, and your ability to hold if needed.

If you are weighing off-plan vs ready property, it helps to compare the real-world costs, timelines and what happens if the market cools. Our team also recommends understanding payment plan structures before you choose a project.

Valuation, appraisal and how often to revalue

The questions we see in your research sheet are common: “Different types of property investment” is one side of the coin — but the other side is “how often should investment property be valued” and “how often should investment property be revalued”. In practice, valuation is a tool you use at specific moments, rather than something you do on a fixed calendar.

When revaluation is actually useful

- Before refinancing: lenders and mortgage providers typically require an up-to-date valuation.

- After major changes: a renovation, a reconfiguration, or a meaningful building upgrade can change market value.

- When the market shifts: if comparable sales move materially, your strategy might need adjusting.

- Before selling: a valuation (and a good comparables review) helps you price realistically and avoid wasting time.

A simple “appraisal checklist” (what to sanity-check)

Property appraisal: quick checklist

- Comparable sales: same building/community, similar size, similar view, similar condition.

- True running costs: service charges, maintenance, insurance (where applicable), management fees.

- Rent evidence: recent lets, not just asking prices; consider seasonality for short-stay assumptions.

- Liquidity: how many similar units are listed right now, and how long they typically take to sell.

- Downside plan: what you will do if rents dip or resale demand softens for 6–12 months.

For investors who also rent out property, Dubai’s official rent tools can help with market context. You can also review official services via the Dubai Land Department portal (including the rental index calculator) to stay grounded in real data.

Pitfalls & gotchas (what tends to trip beginners up)

Most investor mistakes are not dramatic — they’re quiet, small assumptions that compound. Here are the most common ones we see when people choose property types and models without a clear framework.

- Chasing the highest advertised yield: it often comes with higher running costs or weaker resale liquidity.

- Overconfidence in completion timing: timelines matter because your cash flow depends on them.

- Ignoring exit liquidity: the easiest properties to buy are not always the easiest to sell.

- Assuming all buildings are equal: within the same area, building quality and management can make a meaningful difference.

- Not budgeting properly for transaction fees: your “all-in cost” is what determines your real entry price.

Quick costs snapshot (Dubai transaction costs to remember)

- Transfer/registration fees: commonly structured around a percentage fee at transfer (often referenced as 4% in Dubai Land Department service pages), plus administrative items.

- If you use a mortgage: mortgage registration is typically priced as a percentage of the loan amount (DLD service pages reference 0.25%), plus fixed admin amounts.

- Agency / broking fees: vary by deal type and agreement — always confirm what you are paying and when.

- Ongoing ownership costs: service charges and maintenance reserves are not optional — they are part of your investment model.

Step-by-step: choosing a strategy you can stick with

If you want a beginner-safe process, use this checklist before you fall in love with a particular listing. It helps you decide the model first, then choose a property that supports it.

Step-by-step: choosing the right property type and model

- Set your timeline. Are you holding 3+ years, or do you need optionality within 12–24 months?

- Choose the return shape. Prefer steady income, growth-first, or a balanced blend?

- Decide your operational tolerance. Hands-off long-term letting is different from short-term hosting.

- Pick the property category that naturally fits. Apartment vs family home vs off-plan route vs operator-led.

- Run a “net” view. Include service charges, management, expected vacancy, and realistic rent evidence.

- Stress test the plan. What if rent is 10–15% lower than hoped? What if resale takes 6–9 months?

- Confirm the exit. Who is the likely next buyer? What makes your unit easy to resell?

If you can answer all seven clearly, you usually make calmer decisions — and you’re less likely to be forced into a bad move later.

Useful comparisons (so you don’t compare the wrong things)

When investors search phrases like “property investment types” or “property business models”, the confusion is usually caused by comparing two things that behave differently. These quick comparisons help you anchor your decision.

Off-plan vs ready property

- Off-plan: staged payments and future delivery; outcome depends on timeline and market conditions at completion.

- Ready: you can validate real rents, inspect condition, and often start income sooner.

Long-term letting vs short-term letting

- Long-term: typically steadier, lower operational overhead, easier to forecast.

- Short-term: higher operational intensity; performance can be strong, but it is more sensitive to seasonality and management quality.

Apartments vs villas/townhouses

- Apartments: often easier entry, but pay close attention to building quality and service charge dynamics.

- Family homes: can be stable with strong end-user demand, but maintenance expectations are higher.

FAQs: Property Types and Investment Models

Different types of property investment

Most beginner-friendly property investing falls into a handful of models: long-term rental (steady income), short-term letting (more operational, potentially higher gross income), capital appreciation holding (growth-first), off-plan completion strategies (timeline and payment plan led), and value-add (improve and reposition). In Dubai, the “right” one depends on your holding period, cash buffer, and how hands-on you want to be.

How often should investment property be valued

There is no single rule, but a practical approach is to re-check value when you have a reason: before refinancing, before selling, after major improvements, or when the market shifts noticeably. If you are holding primarily for rental income, a periodic comparable-sales review (rather than a formal valuation every year) is often enough to stay grounded.

Different types of property investment UK

The models are broadly similar (buy-to-let, refurbishment, development, holiday lets), but the mechanics differ. Dubai has its own transaction steps, fee structure and rental administration, so it’s important not to assume UK rules map across directly. If you’re a UK investor, treat the strategy logic as transferable — but confirm the local execution details before you commit.

How often should investment property be revalued

Revaluation becomes most useful at decision points: refinancing, restructuring your portfolio, preparing to sell, or adjusting your strategy. Many investors do a light “reality check” annually (rents, comparable sales, running costs) and a formal valuation only when a lender or a sale process requires it.

Want a second opinion on which path fits you best?

Tell us your budget, timeline and whether you prefer income or growth — and we’ll help you narrow down the most sensible options.

Next steps & useful DLH guides

If you’d like to go from “strategy thinking” to a practical buying plan, these guides will help:

- Overseas buyer guide: rules, process and practical checks

- Understanding staged payments: what costs to expect and what to watch

- A step-by-step purchase walkthrough for foreign buyers

Official resources (useful for due diligence)

For official services and real-data tools, it’s worth reviewing:

- Dubai Land Department rental index calculator

- Dubai Land Department: sale registration (mortgaged property) fee reference

- Dubai Land Department: mortgage registration service

- Two levers that drive outcomes Property type shapes demand and running costs; investment model shapes timeline, cash flow, and exit options.

- Beginner-safe starting point Choose your timeline and return shape first, then buy a property that naturally supports that plan.

- Common models investors use Long-term rental, short-term letting, capital appreciation hold, off-plan completion strategies, and value-add improvements.

- Off-plan reality A payment plan is part of the strategy — it changes your risk timing and the point at which your plan must still work.

- Valuation timing Revalue when it supports a decision (refinance, sell, restructure) rather than on a rigid calendar.

If you want a calm, investor-led shortlist (rather than browsing thousands of listings), contact Dubai Light Haven and we’ll map the most sensible options to your plan.

Ready to choose a strategy you’ll still like in 12 months?

Our team will help you align property type, deal structure and payment plan with the outcome you actually want — income, growth, or a balanced approach.

Performance Verified ✅

This page meets PME Optimisation Standards — achieving 95+ Desktop and 85+ Mobile PageSpeed benchmarks. Verified on