Share this post:

Quick summary: Dubai Payment Plan

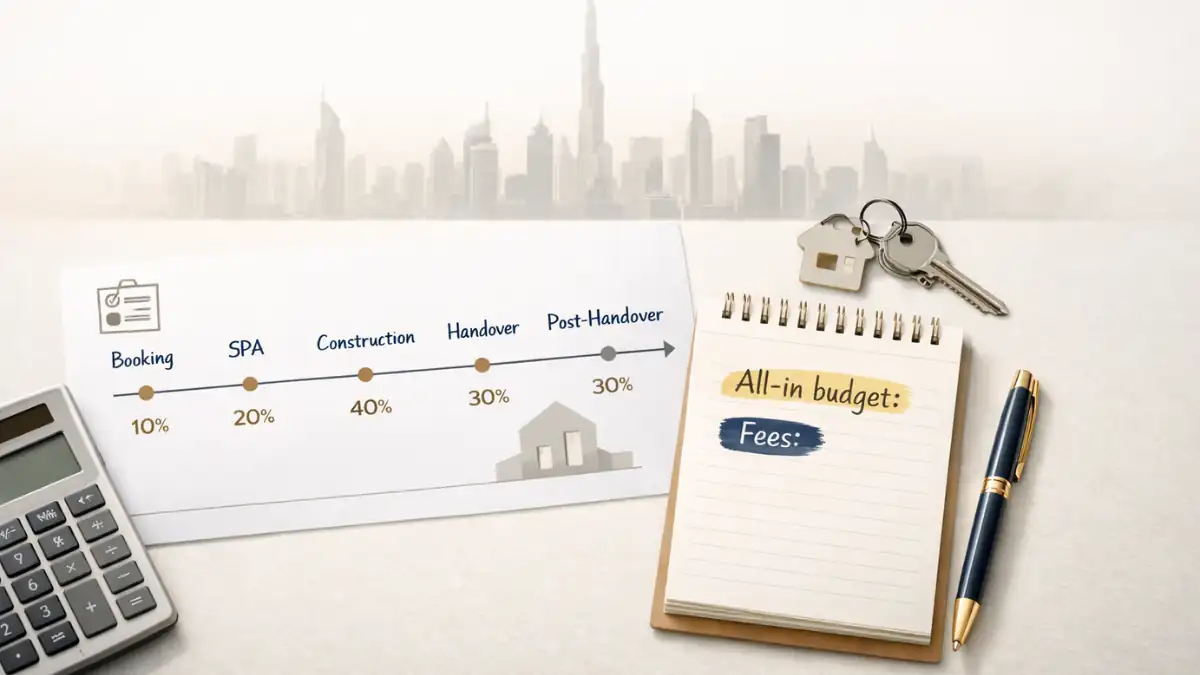

A Dubai Payment Plan is simply a staged way to pay for a property — usually tied to reservation, contract signing, construction milestones, and handover. It can be a sensible route for many investors, but it is not “the full cost” of buying, and it is rarely as simple as the headline advert.

- Typical structures: 10/90, 20/80, 60/40, 70/30, or “1% monthly” style instalment plans (varies by developer and project).

- Two main types: off-plan payment plans (during construction) and ready property payment plans (less common, sometimes via post-handover instalments).

- Upfront cash still matters: expect a booking / EOI plus initial instalment, and then allow for DLD / Oqood registration and admin charges (often separate).

- “Hidden fees” aren’t usually secret — they’re usually in the SPA, fee schedule, or handover pack. The risk is not reading them early enough.

In practice, the best approach is to budget in two layers: (1) your payment plan instalments and (2) transaction + ownership costs (registration, trustee/admin, potential commission, service charges, and utility set-up). Our team can help you sense-check both before you commit.

🎥 Watch: Dubai Off-Plan Reality Check: Your Payment Plan Isn't What You Think

Prefer to watch instead of read? Here’s our quick reality check on Dubai off-plan payment plans 👇Not sure if a Dubai payment plan is actually “good value”?

Send us the payment schedule (or a screenshot of the advert) and we’ll help you estimate the real cash outlay, including the typical fees buyers forget to budget for.

Dubai Payment Plan explained (in plain English)

A Dubai Payment Plan is a structured schedule that splits the purchase price into staged payments. In many off-plan launches, that schedule is designed to keep your monthly or milestone payments manageable while the building is under construction.

However, the headline plan is only one part of the buyer’s “true cost”. In other words, you still need to allow for registration, admin, and ownership set-up costs — and those can come at specific points in the timeline.

How Dubai payment plans work step-by-step

While every developer has their own wording, most instalment plans follow a similar flow. Once you understand the stages, it becomes much easier to spot what’s missing in an advert.

1) Reservation (EOI / booking fee)

You reserve a unit with an Expression of Interest (EOI) or booking amount. Sometimes this is refundable for a short window, but often it becomes non-refundable once the unit is allocated or documents are issued.

2) Contract signing (SPA) + initial instalment

Next you sign the Sale and Purchase Agreement (SPA). This is where the real terms live: payment dates, late-payment clauses, resale rules, admin fees, and what happens if construction is delayed.

3) Construction-linked milestones

Many off-plan payment plans trigger instalments at construction percentages (for example, on completion of foundations, structure, façade, and so on). Some others are calendar-based (monthly or quarterly), which can be easier for budgeting.

4) Handover + final tranche

At handover you typically pay a larger remaining percentage and complete the formalities needed to take possession. Depending on the project, you may also receive a handover pack covering service charges, snagging, and utilities.

5) Post-handover instalments (where offered)

A post-handover payment plan spreads a remaining portion after handover. It can be helpful for cashflow, although you should still check the practical constraints: resale conditions, title transfer timing, and any penalties if you miss payments.

Dubai off-plan payment plan vs ready property payment plan

Many buyers search for “apartment for sale Dubai payment plan” or “villa in Dubai with payment plan” and assume the same rules apply everywhere. In reality, off-plan and ready purchases behave quite differently.

Off-plan payment plans (most common)

- Payments are staged during construction, and the unit is typically registered through the off-plan system.

- You usually have time to build equity before completion, but you are exposed to delivery timelines and SPA terms.

- Resale (“assignment”) rules can apply, especially before a certain % has been paid.

Ready property instalments (less common, more varied)

- Some developers and sellers offer structured instalments, but terms vary more widely.

- Because the property is already complete, fees and transfer steps can happen quickly.

- If you’re buying on the secondary market, broker commission is more likely to be paid by the buyer (commonly ~2% in many deals).

Quick costs snapshot – what buyers typically add on top of a Dubai Payment Plan

- Property registration / transfer: commonly referenced as 4% of the price in many Dubai transactions (often described as 2% buyer + 2% seller in DLD fee schedules, depending on the service and arrangement).

- Title deed issuance: commonly shown as AED 250 in DLD eServices.

- Knowledge & innovation fees: often listed as AED 10 + AED 10 on DLD services.

- Trustee / service partner fees: often a fixed amount or band that varies by channel and transaction type.

- NOC fee: payable to the developer in some transfers (varies by developer and building).

- Ownership set-up: service charges, utilities set-up, and move-in deposits (project-dependent).

These are typical categories buyers budget for. Exact fees and timing should always be confirmed from your SPA, the project’s fee sheet, and official channels.

Real costs & “hidden fees” to budget alongside a Dubai Payment Plan

When buyers say “hidden fees”, they usually mean costs that weren’t mentioned in the advert or the sales call. Most of the time, these aren’t truly hidden — they’re simply buried in documentation you only see after you reserve.

1) Registration (DLD / Oqood) and admin charges

Off-plan properties are typically registered through the off-plan registration route, while ready properties complete via transfer/registration channels. In both cases, you should expect a formal registration cost and small fixed admin line items (for example, title deed and knowledge/innovation fees shown in DLD eServices).

2) Broker / agent commission (sometimes)

On many secondary market purchases, buyers commonly pay a broker commission (often referenced around 2%, and VAT may apply depending on the arrangement). For some off-plan launches, the commission may be covered by the developer — but it is still worth confirming early.

3) NOC fees and developer admin fees

In some buildings, an NOC is required for transfer or certain changes. In addition, certain developers apply admin fees for resale, assignment, or ownership changes. Because policies differ, you want these confirmed before you plan your exit strategy.

4) Service charges, utilities, and move-in costs

Service charges are ongoing, and they can meaningfully affect net yield. Utilities, deposits, and activation costs can also appear right around handover — which is exactly when many buyers are already paying a larger final tranche.

Want a realistic “all-in” budget before you proceed?

We’ll map your instalments against the typical Dubai buying fees, so you can see the real cash requirement month-by-month — not just the brochure headline.

Worked example: what you actually pay (with realistic allowances)

Let’s use a simple example, because this is where most misunderstandings happen.

Example scenario

- Purchase price: AED 2,000,000

- Headline plan: 60/40 (60% during construction, 40% at handover)

- Assumption: instalments spread across booking + milestones

What the instalments might look like (illustrative)

- Booking / initial: 10% = AED 200,000

- Construction stage payments: 50% = AED 1,000,000 (split across milestones)

- Handover payment: 40% = AED 800,000

Now add the “often-forgotten” costs

- Registration / transfer allowance: using the commonly referenced 4% headline as a budgeting placeholder = AED 80,000

- Typical fixed admin line items: title deed issuance and knowledge/innovation fees (small, but real)

- Potential broker cost: if applicable on your deal (often referenced around ~2% in many resale transactions)

- Handover set-up: initial service charges, utilities deposits/activation, and move-in costs (project-specific)

On this example, a buyer who only budgets for the instalments could be short by a meaningful amount at exactly the wrong moment — usually handover. That’s why we recommend planning an “all-in” cash buffer from day one.

What developers don’t tell you (and what to check in the SPA)

Developers are not obliged to make adverts read like a legal document, so marketing will always simplify. Still, there are a few recurring areas where investors get caught out — especially with “pay monthly” messaging.

“1% monthly” plans and what they really mean

When you see searches like “Dubai payment plan 1” or “Dubai pay monthly”, it often points to the popular “1% per month” style structure. That can be a genuinely helpful way to manage cashflow, but you should still ask:

- Is the 1% monthly for the whole term, or only during construction?

- Is there a larger balloon payment at handover?

- Are there admin fees for schedule changes or late payments?

- Does the plan change if construction is delayed?

Developer-specific plans (Emaar, DAMAC, Sobha, Danube, Binghatti, Azizi, and others)

Buyers often look up specific terms such as “Emaar Dubai payment plan” or “Danube Dubai payment plan calculator”. While the names change, the reality is simpler: each project can have its own schedule, incentives, and conditions.

Is Dubai cashless, and can I pay in instalments from the UK?

Dubai is highly digital, but it is not “cashless” in the strict sense. For property payments, you will typically pay via bank transfer, manager’s cheque, or approved payment channels set out by the developer or trustee. If you are paying from the UK, the practical questions become FX rates, bank transfer timings, and proof-of-funds — not whether cash exists.

Pitfalls & gotchas: missed instalments, resales, and delays

Payment plans can be investor-friendly, but only if you understand the downside scenarios. A few careful checks upfront can prevent expensive surprises later.

What happens if you miss an instalment?

Most SPAs include late fees and a cure period. If missed payments continue, termination clauses can apply and you may lose a portion of what you have paid, depending on the contract terms and stage. Because outcomes are contract-specific, it’s worth clarifying the exact process before you sign.

Can you sell before handover?

Sometimes yes, but not always immediately. Many developers apply assignment conditions, minimum paid percentages, and admin fees. If your strategy involves selling before completion, this needs to be confirmed in writing early.

Delays and revised timelines

Construction delays do happen, particularly across large master developments. Therefore, you should understand what the SPA says about revised dates, notice periods, and whether your payment schedule is milestone-linked or calendar-linked.

Step-by-step checklist before you sign a Dubai Payment Plan

How to review a Dubai payment plan (practical checklist)

- Get the schedule in writing. Ask for the exact instalment dates or milestone triggers, not just “pay monthly”.

- Read the SPA clauses on late payment. Check penalties, cure periods, and termination rules.

- Confirm the registration route. Off-plan registration vs ready transfer changes the timing and admin steps.

- Ask about resale / assignment. Check minimum paid % and any admin/transfer charges.

- Budget the add-on costs. Registration/transfer, trustee/admin line items, potential commission, and handover set-up.

- Pressure-test your cashflow. Model a delay scenario and ensure you can still meet instalments.

- Keep a buffer. A practical contingency reduces forced selling if timelines or FX rates move against you.

FAQs: Dubai Payment Plan

How do Dubai payment plans work?

Most Dubai payment plans split the price into stages: reservation, contract signing, construction milestones, and a handover payment. Some plans also include post-handover instalments, although the terms vary by developer and project. The safest approach is to treat the plan as one layer of your budget, and then add the registration and ownership costs on top.

What’s the difference between a pre-handover and post-handover payment plan?

A pre-handover plan is paid during construction, usually linked to build milestones or monthly instalments. A post-handover plan spreads a remaining percentage after you receive the property. Post-handover can help cashflow, but you should still check resale rules, payment enforcement, and whether any admin fees apply.

What does a “60/40” or “80/20” Dubai payment plan actually mean?

It describes how much you pay before handover versus at handover. For example, 60/40 typically means you pay 60% across booking and construction stages, and the remaining 40% when the unit is handed over. The detail that matters is the schedule: the same headline ratio can still produce very different monthly or milestone cash demands.

What do I pay upfront (booking fee / EOI) — and is it refundable?

Upfront amounts vary, but many launches require an EOI/booking plus an initial instalment when you sign. Refundability depends on the developer’s policy and the timing, so you need it confirmed in writing. If it is refundable, check the exact conditions and deadline, because it may change once documents are issued.

What are the real “extra costs” on top of the payment plan (fees, charges, etc.)?

Buyers usually need to allow for registration/transfer costs, admin line items, and sometimes broker commission depending on the type of purchase. In addition, service charges and utilities set-up often arrive around handover. These items are the reason we recommend building an “all-in” budget early, rather than relying on the brochure schedule alone.

Are Dubai payment plans interest-free, or are costs built in elsewhere?

Many developer instalment plans are marketed as interest-free, because they are not structured as a bank loan. Still, pricing can reflect the convenience of staged payments, and some projects offer different incentives for different payment terms. It’s worth comparing the same unit’s pricing under different options, if they are available, before deciding.

Can I pay monthly from the UK (bank transfer, card, direct debit)?

Usually yes, although the method is governed by the developer or trustee process. Most buyers pay via bank transfer or approved channels, and it’s sensible to factor in FX rate movement and transfer timing. For larger instalments, you also want to be comfortable with your bank’s compliance questions and proof-of-funds process.

What happens if I miss an instalment — do I lose the property?

SPAs typically include late fees and a cure period. If payments remain outstanding beyond that, termination clauses can apply and you may lose some of what you have paid, depending on the terms and stage. Because the impact can be significant, we always recommend understanding the late-payment clause before paying any meaningful reservation funds.

Can I sell the property before handover while on a payment plan?

Sometimes, but it depends on the project rules. Many developers apply conditions such as a minimum paid percentage, plus admin or assignment fees, and the buyer’s paperwork still needs to be approved. If your plan relies on reselling before completion, you should confirm the assignment policy in writing before you sign.

When is a Dubai payment plan better than getting a mortgage?

A payment plan can be attractive if you want predictable staged cashflow, you’re buying off-plan, or you prefer to reduce reliance on bank approval. A mortgage can suit buyers who want to complete a ready purchase and spread payments over a longer term, but it comes with bank fees, valuation steps, and lender criteria. In practice, the “better” option depends on your timeline, residency status, and how you want to manage risk.

Want us to review a Dubai payment plan before you reserve?

We’ll highlight the practical fees, timelines, and SPA clauses that matter most, so you can move forward with clear expectations.

Next steps & useful guides

If you’re still comparing options, these next steps usually help you make a calm decision rather than an emotional one:

- Compare like-for-like: same unit type, same view tier, and the same stage of the project.

- Decide your strategy: hold for rental income, flip before handover (if permitted), or long-term capital growth.

- Read our broader guide: Buying Property in Dubai as a Foreigner – What You Need to Know

- Most common use Off-plan purchases where payments are staged across construction, then completed at handover.

- Typical headline formats 10/90, 20/80, 60/40, 70/30, and “1% monthly” style plans (varies by developer/project).

- Budget beyond instalments Allow for registration/transfer/admin line items, plus service charges and utilities set-up around handover.

- Common buyer misunderstanding Assuming the payment plan equals the total cost. In reality, the “all-in” number is higher once fees and ownership costs are added.

- Key risk to check Late-payment clauses, assignment/resale conditions, and what “handover” means in the SPA wording.

If you want, send us the schedule you’ve been offered and we’ll help you map the instalments and typical fees into one clear timeline. Contact Dubai Light Haven.

Official references (useful when you’re checking fee line items)

Fees and service names can change, so it’s always sensible to cross-check against official channels when you’re validating a fee schedule.

- Dubai Land Department eService: transfer of ownership

- Dubai Land Department eService: issue title deed

- Dubai Land Department eService: registration fee transfer (fee schedule reference)

Ready to move forward — with clarity?

Our team will help you sanity-check the payment plan, model the all-in cash requirement, and flag the SPA clauses that matter most for investors.

Performance Verified ✅

This page meets PME Optimisation Standards — achieving 95+ Desktop and 85+ Mobile PageSpeed benchmarks. Verified on